Ector County Utilized Informal and Formal Appeals to Reduce Taxable Value by $131 Million

O'Connor discusses how Ector County utilized informal and formal appeals to reduce taxable value by $131 million.

ODESSA, TX, UNITED STATES, November 5, 2025 /EINPresswire.com/ --Ector County is what many people picture when they think of Texas. Built around the oil industry, surrounded by windswept plains, and filled with rural communities, Ector County has an Old West charm that naturally flows from the people and the community. Ector has long had a friendly rivalry with neighboring Midland County, as the two have clashed over oil and football for decades. Both have seen a resurgence in recent years and have rebounded both economically and culturally. This return to form has only one real drawback, and that is increasing property values and taxes.

Both homes and businesses saw large spikes in the taxable value in 2025. While some of this was thanks to natural growth, there was a lot of evidence that these values were being hyped by the Ector County Appraisal District (Ector CAD). To oppose this, many property tax appeals were launched, though Ector does utilize this technique less than other counties. With both informal and formal appeals now settled, the effects on homes and businesses can be studied to see how taxpayers benefited from fighting their taxes.

Appeals Help Slow Historic Value Rise in Homes

Ector CAD started 2025 by handing out a huge increase in residential value of 7.3%, which reached a total of $9.21 billion. It was also estimated that 30% of homes were overvalued. Property tax appeals were launched, and after they were done, homes saw an overall reduction of 0.1%, bringing the combined value to $9.19 billion. Homes worth between $250,000 and $500,000 were responsible for $4.28 billion after a reduction of 0.1%. Homes under $250,000 contributed $3.94 billion, achieving a cut of 0.1% as well. As properties became more expensive, the value of their reductions increased. For instance, homes worth over $1.5 million saw a decrease of 0.5%.

Like neighbor and rival Midland County, Ector is built around modest homes. $5.05 billion in taxable value came from homes under 2,000 square feet, following a reduction of 0.1%. Residences from 2,000 to 3,999 square feet likewise dropped by 0.1%, achieving a new sum of $3.62 billion. The largest reduction of 0.5%, which saw homes measuring between 4,000 and 5,999 square feet fell to $364.88 million. True luxury homes saw a cut of 1.1%, landing a total of $75.51 million.

When looked at by age of construction, taxable value is spread out in a relatively even manner, though new construction is starting to be felt quite strongly. The building boom of 2001 to 2020 was in first place with $2.95 billion after a reduction of 0.1%. In second place were the oldest homes, which dropped 0.1% to $2.57 billion. Those from 1961 to 1980 fell 0.1% to $1.64 billion following appeals. New construction totaled $1.12 billion after a cut of 0.5%. While these new homes got the largest reduction, they also had the largest spike at 34.2%.

Commercial Appeals Achieve Better Results Than Residential Protests

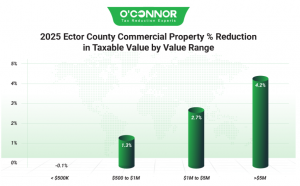

Business properties saw a similar value bump from Ector CAD at 6.8%. However, appeals were used much more efficiently than homes and were able to help counterbalance some of the spikes. This may be because commercial properties are consistently protested every year. The initial spike was an increase of 6.8%, which took the total to $4.02 billion. Appeals managed to reduce this by 2.9%, resulting in a new sum of $3.91 billion. The largest total and highest cut came for business properties worth over $5 million, which shed 4.2% of value for a grand total of $1.96 billion. Commercial properties worth between $1 million and $5 million saw a reduction of 2.7%, which resulted in a final tally of $1 billion. Those worth between $500,000 and $1 million saw a total of $375.02 million after a cut of 1.3%.

The largest commercial property block by far was offices, which saw a total of $1.64 billion following a reduction of 1.2%. Apartments were a distant second with a final tally of $934.88 million, though they had the highest reduction of an outstanding 8.2%. Warehouses dropped 1% to $524.87 million, while retail remained neutral at $349.75 million. Hotels fell an impressive 5% to $235.71 million. Raw land, like retail, remained neutral.

Opposed to homes, commercial properties were much less diverse when it came to age of construction. The boom period of 2001 to 2020 was responsible for 46.4% of all value, which came to $1.81 billion after appeals. Business real estate from 1961 to 1980 came in second with $946.86 million following a cut of 5.3%, the largest decrease. From 1981 to 2000 contributed $660.43 million after falling 3.4%. New construction dropped 2.7% to a total of just $126.11 million, though it was the fastest riser with a 2025 increase of 18.6%.

Apartment Appeals Slice Deep into a Large Increase of 15.5%

Apartments saw the largest commercial property spike, outside of hotels, at 15.3%. This translated into a 2025 initial total of $1.02 billion. Appeals were quite aggressive, however, and this eventually dropped by 8.2% to $934.88 million. Construction from 2001 to 2020 experienced a drop of 3.5%, reaching a total of $448.26 million. Construction from 1961 to 1980 was able to knock off 14.5% of value thanks to appeals, securing a new tally of $268.41 million. Apartments built from 1981 to 2000 nabbed a strong cut of 9.2%, achieving a total of $208.14 million. Strangely, new construction neither added nor removed any value.

Ector CAD broke apartments down into three categories for measurement purposes. Generic apartments dropped 8% for a total of $884.88 million. Garden apartments got a large decrease of 11.8%, transforming their combined value to $49.96 million. Subsidized housing reached $32,676 with no gain or loss.

The No. 1 commercial property in Ector County, offices, started 2025 by growing 2.2% to $1.66 billion. Thanks to aggressive appeals, an overall reduction of 1.2% was achieved, leaving a new figure of $1.64 billion. 51.2% of all office value was constructed between 2001 and 2020, which resulted in a final number of $840.81 million after a reduction of 1.5%. Offices from 1961 to 1980 dropped 1.1% to $437.73 million, while those from 1981 to 2000 fell 0.5% to $240.37 million. New construction saw a small reduction of 0.4%, bringing its total to $51.21 million. New construction had added 12.8% in value at the start of the year.

Ector CAD used only two office subtypes. Low-rise offices dropped 1.3% to $1.51 billion, while medical offices stood at $126.31 million.

Warehouses Shed $5.22 Million in Value

Warehouses are No. 3 in Ector County when it comes to commercial value. Warehouses were hit with an increase of 6% at the beginning of 2025, raising their total to $530.10 million. Informal and formal protests combined to knock 1% off the total, creating a new sum of $524.87 million. Following a reduction of 0.4%, warehouses built from 2001 to 2020 totaled $188.40 million. Those built from 1961 to 1980 reached $127.09 million after being cut by 0.4%, while those from 1981 to 2000 retreated from 0.4% to $108.38 million. New construction garnered the largest reduction, falling 7.2% to $42.64 million, though it had previously grown 20%.

There were three types of warehouses according to Ector CAD. $457.84 million in value came from generic warehouses, which also saw a cut of 1.1%. Mini warehouses dropped 0.4% to $61.55 million. Office warehouses, meanwhile, neither grew nor shrunk.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.